I would call myself one of the lucky few. My parents actually gave me the tools I needed to be able to understand the importance of saving. The impact that debt could have on my future.

I was also fortunate that my parents paid my way through college. I’m an only child so they didn’t have to budget for anyone but me. One of the perks of being an only child.

I was always taught that as long as I was getting good grades and making good decisions with my life that they would help me get through college…financially {and emotionally – ha!} Thankfully I had a decent head on my shoulders and I wasn’t too much of a rebel. They not only paid for my school, but they paid for my living expenses.

They didn’t let me off easy though.

I was still required to hold a part time job all while taking on a full load of classes and being a part of a college dance team. See, they taught me to be responsible.

This allowed me to graduate debt free. Not a lot of people can say they graduated and had absolutely no college loans to pay back, right?

I’m not telling you all of this so that you can say, “Oh, how lucky you were Mandy!”

That’s not my reason at all.

In fact, when I met my husband, I inherited quite a bit of debt. I quickly realized that it didn’t matter how well I {or my parents} had planned for my future. If my soon-to-be spouse was in debt….it meant I was in debt too.

I always lived with the mentality that if you can’t afford it then don’t buy it. I hated credit cards. Despised them.

But, the husband? The husband was quite the opposite. He was a spender. He had his college paid for too, not by his parents, but by the National Guard. Yet he still took out student loans so that he could buy things like big screen tvs. And he racked up credit card balances on going out and partying .

Unfortunately he didn’t realize that the easy money he was getting in college would one day have to be returned to the bank. What a bummer. It seemed so free at the time.

When we started our life together and merged our finances…our bank accounts {and our spending habits} were extremely different. I can recall numerous times where we fought over “spending” money. What we could afford and what we wanted to afford were two different realities.

My husband ended up getting deployed 1 month in to our marriage and I can honestly say that if it weren’t for his deployment, we may still be in debt. The only good thing about fighting a war in Iraq? It allowed us to pay off all of the debt he had acquired from his college spending spree.

It gave us the ability to start our life out on the right foot. For him, it meant that he no longer had to pedal backwards…the wheels were moving forward. We vowed from that point forward to stay out of debt.

It was our new mentality.

We agreed that we would consult each other on big purchases {anything greater than $500}. We agreed that we would budget. And eat out less. And do away with some of the “wants” that kept us from getting ahead to begin with.

You know what’s funny about debt?

It’s so easy to acquire if you’re not careful. Am I right? Somehow we have managed to stay on track and only spend money on things we can afford.

But you know what I love most about my husband?

It’s not the fact that he decided to be a financial advisor, or that he compromises when it comes to spending, or that he allows me to run our household finances. It’s none of those things…although those are all great qualities.

It’s the fact that he wants to HELP people. YOU. He’s genuine and sincere. He truly has a passion for helping people avoid the mistakes that his father made regarding debt. Or the mistakes that he made early on in his life.

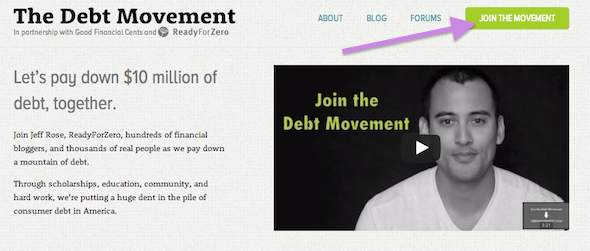

He has started “movements” in the past, but none as life changing as this. The Debt Movement.

He wants to help people pay off $10 million dollars worth of debt in 90 days. He created The Debt Movement so that he could supply the tools and resources people need to finally get off their butts and tackle paying down their debt.

There will be debt scholarships. Yes, FREE money…as in OVER $15,000 worth of free money that you can earn to pay down your debt! If that doesn’t get our attention I don’t know what will.

And he’s not doing this for ANY other reason than because he wants to help. Because his one desire in life is to change lives.

Didn’t God pair me with a good man? Thankful is an understatement.

We all can relate to being in debt. Whether it’s YOU or a friend, co-worker, parent, sibling…someone you know is struggling with debt.

It’s time to break the habit. JOIN THE DEBT MOVEMENT. It’s a free program that will help you pay down your debt and give you the chance to win a debt scholarship.

Find out more by visiting DebtMovement.com and clicking on “JOIN THE MOVEMENT”.

[ois skin=”Home Tour 2″]

This is just like what my boyfriend and I are going through right now except, I took out about $10,000 in school loans and went to a college 2 hours away from Vegas and never actually saw the inside of my college so now I have to repay those back plus while partying in Vegas I got a credit card so now we have that debt plus I didn’t know my father dropped me from his health insurance 2 years early and continued going to doctors so now we have medical bills. My boyfriend only has his car as a debt. It’s definitely difficult when you are trying to build a life together. But we are now starting to pay off the debt and hopefully soon we will be debt free!

We have very similar stories Mandy! Only difference is my husband is still active duty and I’m the one on a similar mission to your husband’s :-). Looking forward to helping out in the Debt Movement, he has been working hard that is for sure! It’s going to be great and I am beyond excited. Great blog post BTW!

Signed up! Thanks for sharing, Mandy! Your husband is awesome 🙂 LOVE what he’s doing!

This is awesome! I know how it feels to start a life/relationship with someone who isn’t as financially savvy as you. It’s SO stressful and the cause of MANY MANY MANY fights. How great that you both work together to make the household work. My husband and I finally got on the same page financially and it’s so much easier for our marriage. The Debt Movement sounds great!

Amazing man he is! Four years ago, we had almost $40K in debt and we now have a little over one year and a half to go in our five year program to pay off everything. It’s been hard – we pay $900 a month towards the cards, but it’s been very freeing and we’ve learned to live without credit. Crazy thing is outside of some kitchen renovations and furniture, most of it was junk! But I can’t wait until I get that final CC statement with a zero balance!

@ Wendy

That’s such a great story! Kudos to you and your hubby’s for stepping up and knocking down your debt in a flurry.

If you ever want to share your story on the Debt Movement blog, I would love to feature you. Stories like this is what people need to hear. Especially those that feel like they will never become debt free.

My husband inherited my credit card debt, and I inherited his student loans, so we are working overtime to get our finances straight…it’s taking a lot of hard work, but we are slowly getting there. I can’t wait to read more about the Debt Movement and see how it can help us! Thank you!

This is great! Our new years resolution was so pay off all of our credit card debt and medical bills. I am definitely joining the movement to help stay focused and be successful! Thank you!

I hate debt, too, hate it. I too graduated college with no debt and always paid off my credit cards. However, when I went through a divorce, the legal bills were overwhelming… I really had no choice, because I needed to fight for my kids. Thankfully, I have almost paid off all of that debt (around $40,000) today and I have the custody I wanted with my children. I did it by making wise choices, not overspending. Sometimes debt happens even when we don’t want it to… in my case I decided my kids were more important than my debt.

Thanks for sharing your story, Mandy. It’s good to know that other people have been through this. My husband and I have credit card debt and last year we came to a breaking point. I bawled and was so overwhelmed thinking that we would NEVER be able to pay it all off. Then we joined Dave Ramsey’s FPU and it has changed our lives. We still have credit card debt but it is disappearing thanks to getting help.

Mandy,

Thanks for posting this. Unfortunately for my husband, I am the spender who gets us in to trouble. I seem to have hit rock bottom and I’m hoping a program like this can help me get on the right path!

cool, thanks for the info- will look into

Thank you so much for sharing this! I joined right away and hopefully it will help my husband and I get back on our feet! We’ve collected so many medical bills over the last year that its ridiculous on top of our car debt. My husband had a serious back injury and had lost his job so we were only making it on my income which was nothing compared to his. Once he was working again we started to get back on our feet until I lost my job. It seems like once we start going forward we get pushed right back down. We need some motivation in this household!!

I think it is fantastic that your husband (and you!) are doing this. My husband and I have been working hard for the past almost two years to pay off debt and as of last month… we are debt free except for the house!

We paid off a home improvement loan, got out of the mindset that we had to have nice cars with big car notes, and for the first time in our marriage, actually discussed the big B word (budget… groan). It wasn’t fun, but it was totally worth it.

Good luck with the debt movement!

I am proud to say that I have less than $500 left on one of my student loans!! Of course I have 20K left on my other ones ha! Focusing on the small victories. Guess I need to go sign up for The Debt Movement!

Dear MANDY

I liked what you said about I was still required to hold a part time job all while taking on a full load of classes and being a part of a college dance team

Follow this kind of items because they are very good, congratulations.

So I have been waiting for the release of this book and the timing could not be more perfect. I preordered a copy for my husband for his bday! We plan to read it together. We are huge advocates of the no debt policy and we have been climbing our way out of the debt pit for 15 years. We have 5 degrees between us (and we paid for ALL of them) and we own a small business. I am excited to hear any new and helpful info that Jeff has to offer us! On a side note, my hubby and my kiddo have Ipads. I have been left out of the Ipad family and I would be so blessed to have one! I work from home but spend much of my time in the car shuttling my daughter and I would love to be able to work while I wait for her at dance. the time with you would be a blessing too, as I am new to the blog world. Thanks for all of this goodness today Mandy! Blessings! Susan